How Succentrix Business Advisors Empower Startups With Professional Suggestions

How Succentrix Business Advisors Empower Startups With Professional Suggestions

Blog Article

Maximize Your Revenues With Expert Advice From a Service Accounting Expert

By recognizing your special service requirements, they offer insights right into budgeting, tax obligation planning, and cash circulation monitoring, making sure that your monetary resources are maximized for development. The real question continues to be: exactly how can you identify the right expert to direct you through the intricacies of monetary decision-making and unlock your company's complete capacity?

Understanding the Duty of Accountancy Advisors

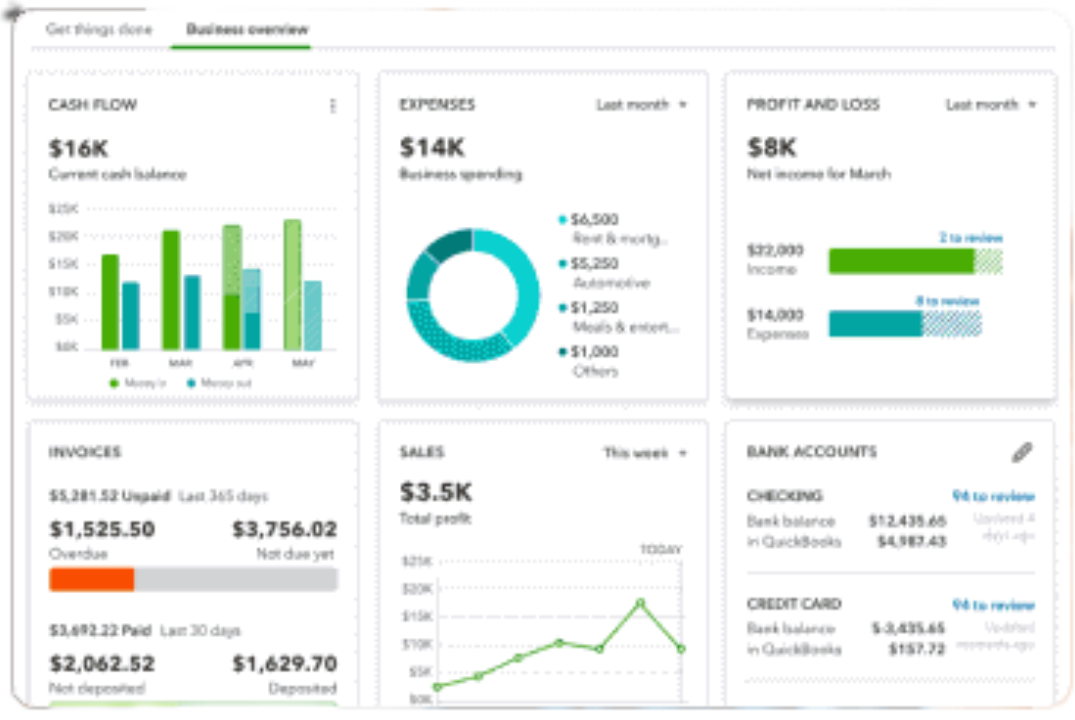

Furthermore, audit advisors assist in analyzing economic data, enabling entrepreneur to understand their monetary setting and possible locations for development. They also play a considerable function in budgeting and projecting, ensuring that companies allot sources efficiently and plan for future costs (Succentrix Business Advisors). By suggesting on tax obligation strategies and compliance, these professionals help reduce obligations and enhance monetary results

Moreover, accounting experts might help in determining cost-saving possibilities and boosting functional effectiveness, which can cause improved earnings. Their proficiency reaches providing understandings on financial investment choices and run the risk of administration, assisting companies toward sustainable development. On the whole, the duty of audit consultants is important to promoting a solid economic structure, equipping businesses to prosper in an affordable atmosphere.

Benefits of Specialist Financial Support

Expert financial guidance supplies many advantages that can significantly boost a service's financial approach. Involving with a financial expert supplies access to specialist understanding and insights, enabling businesses to browse complicated economic landscapes a lot more efficiently. This proficiency aids in making notified choices relating to financial investments, budgeting, and expense management, consequently optimizing source allotment.

In addition, professional experts can identify possible risks and possibilities that may be ignored by internal groups. Their unbiased point of view help in developing durable monetary forecasts, allowing businesses to prepare for future development and reduce possible troubles. Financial advisors can assist simplify accounting processes, making certain compliance with guidelines and decreasing mistakes that could lead to financial charges.

Trick Solutions Offered by Advisors

Amongst the necessary services given by economic advisors, strategic monetary planning stands out as a critical offering for services seeking to improve their fiscal health and wellness. This involves detailed analysis and forecasting to straighten financial sources with long-term service objectives, making sure sustainability and growth.

Furthermore, tax obligation planning is an important solution that helps companies browse complex tax laws and optimize their tax responsibilities. Advisors work to determine possible reductions, credit histories, and approaches that minimize tax problems while ensuring compliance with laws.

Capital management is another essential solution, where experts aid in monitoring and optimizing money inflows and discharges. Reliable cash money circulation administration is crucial for maintaining liquidity and supporting ongoing operations.

Advisors likewise give economic coverage and evaluation, supplying understandings through detailed reports that enable company owner to make informed decisions. These reports frequently include crucial performance signs and pattern analyses.

Lastly, risk management services are important for identifying potential financial threats and creating methods to alleviate them. By attending to these dangers proactively, companies can protect their assets and ensure lasting security. Collectively, these services empower companies to make informed financial choices and achieve their goals.

Choosing the Right Bookkeeping Advisor

Selecting the right accounting consultant is an essential decision that can significantly influence an organization's monetary success. To make an informed selection, take into consideration numerous essential factors. To start with, examine the advisor's credentials and credentials. A state-licensed accountant (CPA) or a specialist with relevant classifications can provide guarantee of know-how and compliance with guidelines.

Additionally, evaluate their experience within your sector. An advisor aware of your certain market will certainly understand its special obstacles and opportunities, enabling them to use customized suggestions. Search for somebody that shows an aggressive approach and has a record helpful organizations achieve their financial goals.

Communication is important in any type of consultatory connection. Choose an advisor who focuses on open and clear discussion, as this promotes an efficient partnership. Think about the range of solutions they use; an all-round advisor can provide understandings beyond basic audit, such as tax obligation technique and financial projecting.

Finally, trust your reactions. A strong relationship and shared worths are vital for a Full Article long-term cooperation. By taking these elements right into account, you can choose a bookkeeping expert who will certainly not only meet your requirements but additionally add to your business's general growth and productivity.

Real-Life Success Stories

Successful companies usually credit their bookkeeping consultants as vital gamers in their financial achievements. Succentrix Business Advisors. By engaging an accountancy expert, the company executed extensive monetary projecting and budgeting methods.

In an additional case, a start-up in the technology industry was grappling with rapid growth and the complexities of tax compliance. The service employed the proficiency of a bookkeeping consultant who streamlined their financial processes and established an extensive tax strategy. As a result, the startup not just minimized tax obligation responsibilities yet additionally safeguarded added financing by providing a robust financial plan to investors, which significantly increased their development trajectory.

These real-life success tales show how the right accounting expert can change monetary challenges into possibilities for development. By offering tailored strategies and understandings, these professionals encourage companies to optimize their economic wellness, allowing them to achieve their long-lasting goals and optimize earnings.

Verdict

In final thought, the proficiency of a company accountancy advisor shows important for taking full advantage of revenues and achieving sustainable development. By giving tailored strategies in budgeting, tax planning, and cash money circulation administration, these professionals encourage companies to browse economic intricacies effectively. Their aggressive strategy not just identifies opportunities for improvement however also mitigates prospective threats. Engaging a knowledgeable accounting consultant eventually places businesses for informed decision-making and lasting success in an ever-evolving market landscape.

Accountancy advisors play an essential duty in the economic health and wellness of an organization, supplying vital guidance on numerous monetary issues.Additionally, accounting experts assist in interpreting economic information, allowing company proprietors to recognize their financial position and prospective areas for growth.Specialist economic guidance uses many benefits that can dramatically boost a business's economic method. Engaging with a financial advisor offers access to specialist understanding and link understandings, permitting organizations to navigate complex economic landscapes more efficiently. They can align financial planning with specific organization great site goals, making sure that every monetary choice contributes to the overall calculated vision.

Report this page